by Loretta Hartzell

Medicare is a federal health insurance program for the following: people 65 or older, people under 65 with certain disabilities or people of any age with End-Stage Renal Disease (ESRD) (permanent kidney failure requiring dialysis or a kidney transplant).

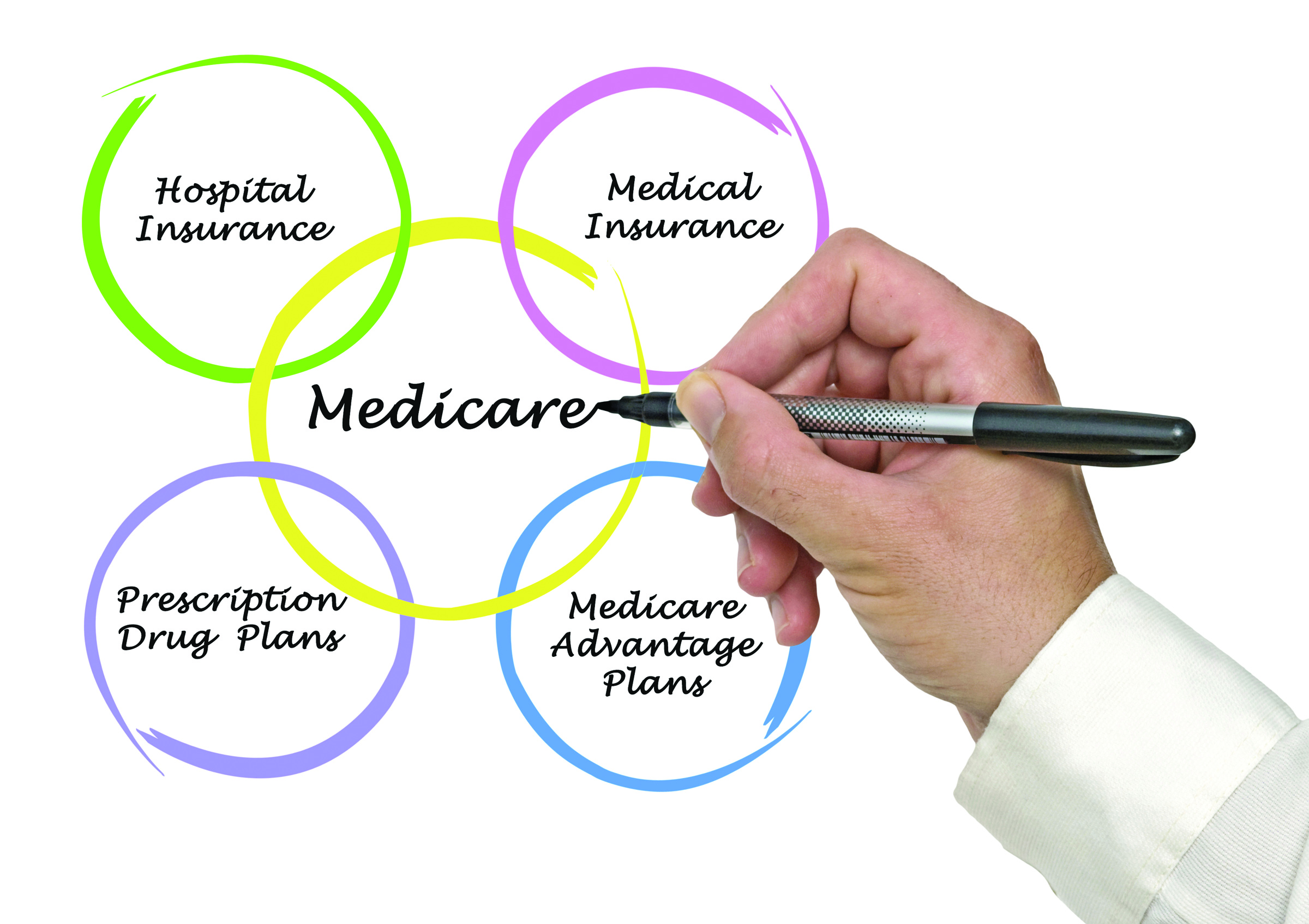

The different parts of Medicare help cover specific services:

Part A – Hospital Insurance

Part B – Medical Insurance

Part C – Medicare Advantage

Part D – Medicare Prescription Drug Coverage

Medicare Parts A and B Known as Original Medicare Part A helps to covers inpatient care in hospitals, inpatient care in a skilled nursing facility but not custodial or long term care, hospice services and home health services which are very limited and only for those who are homebound.

Part B helps to cover services from doctors and other health care providers, hospital outpatient care, durable medical equipment and home health care. There is a deductible for Part B and in 2015 it is $147 for the year.

Premiums for Part B which are typically deducted from you social security check are based on your income. Go to www.medicare.gov and click on the tab at the top Your Medicare Costs then click on Your Part B costs.

Part C Medicare Advantage is a type of Medicare health plan (like an HMO – Health Maintenance Organization) offered by a private company that contracts with Medicare to provide both Part A and Part B. If you are enrolled in a Medicare Ad-vantage plan, your Medicare services are covered through the plan and are not paid under Original Medicare.

Usually these plans include prescription drug coverage and may include extra benefits like vision, hearing, dental and other health wellness programs.

In addition to your Part B premium, you might pay a monthly premium for the Medicare Advantage Plan. These plans can change each year.

Part D prescription drug coverage helps cover the cost of out-patient prescription drugs. These plans are offered by private insurance companies that have been approved by Medicare. These plans change each year.

If you are enrolled in Original Medicare (Parts A and B) you need to be enrolled in a Part D Prescription Drug Cover-age when you are first eligible to avoid a late enrollment penalty. An exception would be if you have “creditable” prescription drug coverage through your employer.

Your monthly premium will be based on the drug plan you select and may be increased if your income is above a certain limit, you’ll pay an income-related monthly adjustment amount. Go to www.medicare.gov and click on the tab at the top Your Medicare Costs then click Costs for Medicare drug coverage for additional information.