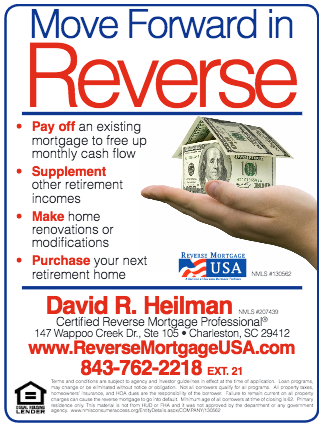

by David R. Heilman, MBA; Certified Reverse Mortgage Professional

The old notions that reverse mortgages should only be taken out as a last resort simply is no longer true today. This product is much more versatile than many realize. The truth is reverse mortgages are not for everyone, but everyone nearing retirement should get the facts, know how they work and potentially use them as part of the overall retirement plan.

A reverse mortgage is a unique Federal Housing Authority-Insured loan that enables homeowners 62+ to convert part of the equity in their home into cash without having to sell the home, give up title, or make a new monthly mortgage payment.* They are also non-recourse loans meaning if the balance of the loan grows to be higher than the actual home value over time – the borrower(s), estate, or heirs are NOT responsible for any deficiency. Only the sale of the house is responsible for the repayment of the debt. If there is still equity in the home at the time of the last surviving borrower’s death– that belongs to the heirs or estate after the home is sold.

This loan program was created under President Reagan’s Administration. The first Home Equity Conversion Mortgage (HECM) was in 1989 and the program has been evolving ever since to the safe retirement planning tool it is today. Whether it’s simply establishing a line of credit (which grows over time) for future needs, paying off current mortgage balances in order to free up immediate cash flow, or supplement monthly income – all are safe ways to tap home equity in retirement.

Real Life Success Stories

Janice recently lost her husband and therefore a reduction in income needed to maintain the home they enjoyed together for many years. She really didn’t want to sell plus the home was where she felt most comfortable, safe, and independent. The value of her home was $400,000 and her current home equity line of credit (HELOC) had a balance of $50,000. At age 71 the reverse mortgage allowed her to pay off the equity line, therefore freeing up monthly cash flow once allocated to the payment, and supplement her monthly income by $700 a month for the next 10 years. Finally she put the remaining funds in the line of credit. Now she has the security of knowing there are funds available when needed and she lowered her monthly expenses while increasing her monthly income. She would have never realized this financial freedom had she not taken the time to learn about the benefits of a reverse mortgage.

Another option even less known is a reverse for purchase. Many older adults wish to move closer to family/friends or “right-size” their home as their needs are changing. Moving and taking on a new monthly mortgage payment is downright terrifying. But this wasn’t the case for David and Kay, both 63 who wanted to move to their retirement home on the lake. With the sale of their current residence they received $300,000 cash and purchasing their next primary residence was going to take up almost all of their nest egg. Since they didn’t want to add to their monthly expenses with a traditional mortgage, they took the time to understand the benefits of a “reverse for purchase”. With a combination of reverse mortgage proceeds and cash down they were able to purchase their new retirement home and retain a decent portion of their nest egg for other retirement needs.

Another option even less known is a reverse for purchase. Many older adults wish to move closer to family/friends or “right-size” their home as their needs are changing. Moving and taking on a new monthly mortgage payment is downright terrifying. But this wasn’t the case for David and Kay, both 63 who wanted to move to their retirement home on the lake. With the sale of their current residence they received $300,000 cash and purchasing their next primary residence was going to take up almost all of their nest egg. Since they didn’t want to add to their monthly expenses with a traditional mortgage, they took the time to understand the benefits of a “reverse for purchase”. With a combination of reverse mortgage proceeds and cash down they were able to purchase their new retirement home and retain a decent portion of their nest egg for other retirement needs.

- Net Proceeds from Sale of Previous Home=$300,000

- Purchase Price of New Home=$280,000

- Reverse Mortgage Funds=$140,000

- Cash Needed from Previous Sale=$140,000

- Net Cash Left for Other Retirement Needs=$160,000

These stories are actual client examples and only realized by the people that chose to learn for themselves how it works. It cost you nothing to take the time and learn from the professionals at Reverse Mortgage USA if a reverse mortgage is right for you.

*Borrowers are required to pay all taxes, insurance, HOA and maintenance on the home as well as maintain the home as primary residence.