There are several different types of Medicare plans. The choices vary from the services covered to the type of administrators who manage the plan. People who are eligible for Medicare commonly choose the Original Medicare Plan or a Medicare Advantage Plan.

The Original Medicare Plan is a fee-for-service plan managed by the federal government. Most people on the Original Medicare Plan have a combination of what is referred to as Part A and Part B benefits. Additionally, recipients of Original Medicare have the option of adding what’s called a Medicare Prescription Drug Plan (or Medicare Part D plan) and purchasing a Medigap or supplemental policy to cover what the Original Medicare does not. Medicare Advantage plans are an HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization) that can provide Parts A, B and D coverage all in one.

Medicare Part A: Medicare Part A covers inpatient hospital care. Medicare Part A is offered to those who paid Medicare taxes while working. For most, it is not necessary to pay a monthly premium for the coverage. Others who have not paid Medicare taxes can buy Part A coverage. Medicare Part A is available for medically necessary blood, home health services, hospice care, hospital stays and skilled nursing facility care when recipients meet certain conditions.

Medicare Part B: Medicare Part B is optional and requires that people who enroll pay a monthly premium. Additionally, co-payments and deductibles may apply to these services. Medicare Part B covers services that Medicare Part A does not, such as outpatient care, doctors’ services and other medical services. Medicare Part B covers services that are medically necessary and some preventive services.

Part C: Medicare Advantage Plans: Medicare Advantage Plans are offered by private companies and approved by Medicare. Members of Part C plans are still on Medicare. Medicare Advantage Plans provide the same coverage as Part A and Part B. Many also provide extra benefits and Part D prescription drug coverage. Types of the Medicare Advantage Plan include: Preferred Provider Organization (PPO) Plans, Health Maintenance Organizations (HMO) Plans, Private Fee for Service Plans (PFFS), Special Needs Plans and Medicare Medical Savings Account (MSA) Plans. Members of Medicare Advantage Plans do not need Medigap or supplemental insurance and in most cases cannot be enrolled in Medicare Part D.

Part D: Prescription Drug Coverage: Medicare Part D offers prescription drug plans from private companies that are approved by Medicare. Prescription Drug Coverage is optional and members who wish to receive the benefits must pay a monthly premium. Prescription Drug Coverage is available through Medicare Part D or through private insurers offering Medicare Advantage Plans. Different plans have different options based on cost, drug coverage and convenience.

Medigap Policy or Medicare Supplemental Insurance: A Medigap policy, or Medicare Supplemental Insurance, is health insurance sold by private companies to fill in the gaps of the Original Medicare Plan. Medigap policies only apply to individuals receiving benefits from Original Medicare Plans (Parts A and B). These individuals pay the private insurance company a monthly premium for their Medigap policy in addition to the monthly Part B premium that they pay to Medicare. Twelve plans, subject to federal and state laws, are available.

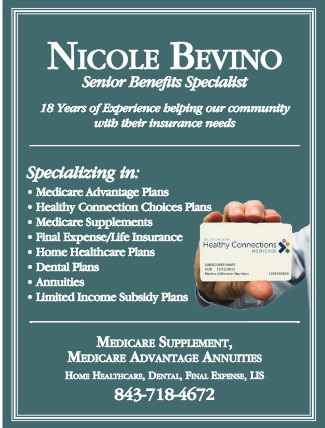

Nicole Bevino has been in the insurance industry for 19 years. Since 2010 she has been specializing in programs for people who gets extra assistance (Limited Income Subsidy). There are programs available for these specific seniors. Many people are unaware these plans are available to them.

Nicole Bevino has been in the insurance industry for 19 years. Since 2010 she has been specializing in programs for people who gets extra assistance (Limited Income Subsidy). There are programs available for these specific seniors. Many people are unaware these plans are available to them.

The ability to explain, what can be very confusing, in simple and easy to understand terms is what empowers seniors to feel confident about their decisions and that is Nicole’s ultimate goal. Meeting with seniors and their children/caregiver is extremely helpful in reaching this goal.

“It is important to give people what they want and need, no more or less. It’s about integrity.”